10 Some Regression models for AF measures

From a policy perspective, in addition to measuring poverty we must perform some vital analyses regarding the transmission mechanisms between policies and poverty measures. Issues we may wish to explore with a regression model include the determinants of poverty at the household level in the form of poverty profiles or the elasticity of poverty to economic growth, while controlling for other determinants. We may also be interested in understanding how macro variables such as average income, public expenditure, decentralization, information technology, and so on relate to multidimensional poverty levels or changes across groups or regions—and across time. Through regression analysis, we can partially study these transmission mechanisms by looking at the determinants of multidimensional poverty. In a regression model, we can account for the effect or the ‘size’ of determinants of multidimensional poverty, which would not be possible with a purely descriptive analysis.

Such analyses are routinely performed for income poverty using what we will term ‘micro’ or ‘macro’ regressions. As is explained below, the term ‘micro’ refers to analyses in which the unit of analysis is a person or household; the term ‘macro’ refers to analyses in which the unit of analysis is a subgroup, such as a district, a state, a province, or a country. This section provides the reader with a general modelling framework for analysing the determinants of Alkire–Foster poverty measures, at both micro and macro levels of analyses.

In general in micro regressions, the focal variable to be modelled may be a binary variable denoting a person’s status as poor (or non-poor) or a variable denoting the deprivation score assigned to the poor. In macro regressions, the focal variable to model is a subgroup poverty measure like the poverty headcount ratio or any other Foster–Greer–Thorbecke (FGT) poverty measure. As with regressions that model the monetary headcount ratio or the poverty gap, macro regressions with ![]() -dependent variables must respect their nature as cardinally meaningful values ranging from zero to one. In these cases, a classic linear regression is not the appropriate model. The common assumptions of the classic linear regression fall short because the range of the dependent variable is bounded and may not be continuous or follow a normal distribution that is often assumed in linear regression models.

-dependent variables must respect their nature as cardinally meaningful values ranging from zero to one. In these cases, a classic linear regression is not the appropriate model. The common assumptions of the classic linear regression fall short because the range of the dependent variable is bounded and may not be continuous or follow a normal distribution that is often assumed in linear regression models.

Generalized linear models (GLMs), by contrast, are preferred as the data analytic technique because they account for the bounded and discrete nature of the AF-type dependent variables. GLMs extend classic linear regression to a family of regression models where the dependent variable may be normally distributed or may follow a distribution within the exponential family—such as the gamma distribution, bernoulli distribution, or binomial distribution. GLMs encompass models for quantitative and qualitative dependent variables, such as linear regression models, logit and probit models, and models for fractional data. Hence they offer a general framework for our analysis of functional relationships.[1]

This section presents the GLM as an overall framework to study micro and macro determinants of multidimensional poverty. Within this framework we are able to account for the bounded nature of the Adjusted Headcount Ratio ![]() and the incidence

and the incidence ![]() while modeling their determinants. We are also able to model these determinants for the probability of being multidimensionally poor.

while modeling their determinants. We are also able to model these determinants for the probability of being multidimensionally poor.

This Chapter is structured as follows. We begin by differentiating micro and macro regression analyses. For this purpose, we review the ![]() measure of the AF class, its consistent partial indices, and the type of variables they represent in a regression framework. We then present the general structure and possible applications of the GLMs to AF measures. We begin with an exposition of linear regression models and how these extend to models for binary dependent variables—logit and probit—and fractional[2] data. We assume readers have some background in applied statistics and key elements of estimation and inference. Our exposition deals with cross-sectional data but could be easily extended to panel data.[3] Before we begin we should point out that the notation used in this chapter is self-contained. Some notation may duplicate that used in other sections or chapters for different purposes. When the notation is linked to discussions in other sections or chapters, it will be specified accordingly.

measure of the AF class, its consistent partial indices, and the type of variables they represent in a regression framework. We then present the general structure and possible applications of the GLMs to AF measures. We begin with an exposition of linear regression models and how these extend to models for binary dependent variables—logit and probit—and fractional[2] data. We assume readers have some background in applied statistics and key elements of estimation and inference. Our exposition deals with cross-sectional data but could be easily extended to panel data.[3] Before we begin we should point out that the notation used in this chapter is self-contained. Some notation may duplicate that used in other sections or chapters for different purposes. When the notation is linked to discussions in other sections or chapters, it will be specified accordingly.

10.1 Micro and Macro Regressions

The AF measures can be used to analyse poverty determinants[4] for a household or person (henceforth we use the term ‘household’) and for a population subgroup. We could study determinants of household or subgroup poverty in a ‘micro’ and a ‘macro’ context. In what follows, the term ‘micro’ refers to regressions where the unit of analysis is the person or household. The term ‘macro’ refers to regressions where the unit of analysis is some spatial or social aggregate, such as a district, state, province, ethnic group, or country. Micro regressions are useful for describing the distinctive features of multidimensional poverty profiles across households (in a given country) or to understand the determinants of poverty. Macro regressions, on the other hand, are useful for studying the determinants of poverty at the province, district, state, or country levels. Both types of regressions use specific components of the AF measures. In the case of micro regressions, the focal variable is the (household) censored deprivation score. From the exposition of Chapter 5, we know that if the deprivation score of a household ![]() is equal to or greater than the multidimensional poverty cutoff (

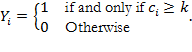

is equal to or greater than the multidimensional poverty cutoff (![]() ), the household is identified as multidimensionally poor. This poverty status of a household is represented by a binary variable (indicator function) that takes the value of one if the household is identified as multidimensionally poor and zero otherwise.

), the household is identified as multidimensionally poor. This poverty status of a household is represented by a binary variable (indicator function) that takes the value of one if the household is identified as multidimensionally poor and zero otherwise.

A natural question that arises is how to analyse the ‘causes’ (in the sense of determinants) that underlie the (multidimensional) poverty status of a household. An intuitive way would be to model the probability of a household becoming multidimensionally poor or falling into multidimensional poverty. A crucial point should be noted here, which may be more particular to multidimensional notions of poverty than their monetary counterparts: when modelling the probability of a household being in monetary poverty, various health- and education-related variables, which are not embedded in the monetary poverty measures, are used as exogenous variables.[5] In a multidimensional case, these exogenous variables may be used directly to construct the poverty measure and so the probability models at the household level are subject to a potential endogeneity issue. For example, if among the explanatory variables we include an asset variable like car ownership, and if that indicator was also included among the ‘assets’ indicator that appears in the multidimensional poverty measure, there will be an endogeneity issue in the model. A typical approach to deal with endogeneity is to use an instrumental variable, but often it is very difficult to find a valid instrument.[6] An alternative approach would be to restrain the set of explanatory variables of the household regression model to non-indicator measurement variables[7]—like certain demographic variables—or additional socioeconomic characteristics of the household. From such a perspective one would be interested in examining household poverty profiles. Sample research questions would be: are female-headed households more likely to be multidimensionally poor? Are larger households more prone to be multidimensionally poor? How does the probability of being multidimensionally poor vary by household size and composition, caste, or ethnicity?

In the case of cross-sectional macro regressions, the focal variables are the ![]() measures at the province, district, state, or country levels, or some other population sub-group or aggregate which leads to a proper sample size.[8] If the focus is on the Adjusted Headcount Ratio

measures at the province, district, state, or country levels, or some other population sub-group or aggregate which leads to a proper sample size.[8] If the focus is on the Adjusted Headcount Ratio ![]() , the focal variables in a macro regression could comprise

, the focal variables in a macro regression could comprise ![]() or could use the intensity

or could use the intensity ![]() and incidence

and incidence ![]() of multidimensional poverty. However, from Chapter 5 we know that

of multidimensional poverty. However, from Chapter 5 we know that ![]() and

and ![]() are partial indices that do not enjoy the same properties as the

are partial indices that do not enjoy the same properties as the ![]() measure. In this Chapter we do not further consider regression models for

measure. In this Chapter we do not further consider regression models for ![]() . Although

. Although ![]() is also a partial index, which violates dimensional monotonicity, we do discuss its analysis, given the prominence of existing studies using the unidimensional poverty headcount ratio.

is also a partial index, which violates dimensional monotonicity, we do discuss its analysis, given the prominence of existing studies using the unidimensional poverty headcount ratio.

As already noted, ![]() and

and ![]() are bounded between zero and one. In statistical terms,

are bounded between zero and one. In statistical terms, ![]() and

and ![]() are fractional (proportion) variables that lie in the unit interval. Their restricted range of variation limits the use of the linear regression model because these models assume continuous variables comprised between

are fractional (proportion) variables that lie in the unit interval. Their restricted range of variation limits the use of the linear regression model because these models assume continuous variables comprised between ![]() and +

and +![]() . A natural model to be considered is one that reflects the fractional nature of any of these two indices (see section 10.4).

. A natural model to be considered is one that reflects the fractional nature of any of these two indices (see section 10.4).

10.2 Generalized Linear Models

Our exposition of GLMs draws on Nelder and Wedderburn (1972), McCullagh and Nelder (1989) and Firth (1991). We treat GLMs in an applied manner covering the basic structure of the models, estimation, and model fitting. We do not provide a detailed exposition of the method itself. Readers interested in a complete statistical treatment of GLMs can refer to McCullagh and Nelder (1989) or to Dobson (2001). The former presents an excellent and comprehensive statistical overview of GLMs, but assumes an advanced statistics background on the part of the reader. The latter presents a briefer and more synthetic exposition of GLMs at a moderate level of statistical complexity.

Generalized linear models are an extension of classic linear models. The linear regression model has found widespread application in the social sciences mainly due to its simple linear formulation, easy interpretation, and estimation. In monetary poverty analysis, linear regression analysis has been used to study the determinants of household consumption expenditures or to model the growth elasticity of per capita income or income poverty aggregates like the headcount ratio or the poverty gap index.[9] Linear regressions are also used to model changes in (i) the income share of the poorest quintile (Dollar and Kray 2004); (ii) adjusted GDP incomes (Foster and Szekely 2008); (iii) the poverty rate (Ravallion 2001); and (iv) the growth rates of real per capita GDP (Barro 2003).

10.2.1 Classic Linear Regression

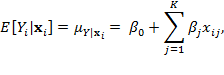

We begin with a brief review of the classic linear regression model and its notation and build on this to present the more generic case of GLMs. The classic linear regression model (LRM) assumes that the endogenous or dependent variable (![]() ) (hitherto referred to as ‘endogenous’) is a linear function of a set of

) (hitherto referred to as ‘endogenous’) is a linear function of a set of ![]() exogenous[10] variables (

exogenous[10] variables (![]() ). The LRM assumes that the endogenous variable

). The LRM assumes that the endogenous variable ![]() is continuous and distributed with constant variance. In addition the LRM may also assume that the endogenous variable is normally distributed. However this assumption is not needed for estimating the model but only to obtain the exact distribution of the parameters in the model. In the case of large samples one may not need to assume normality in a LRM as inference on parameters is based on asymptotic theory (c.f Amemiya, 1985). These assumptions may be inappropriate if the endogenous variable is discrete (binary or categorical)—or continuous but non-normal.[11] GLMs overcome these limitations. They extend classic linear regression to a family of models with non-normal endogenous variables. In what follows, random variables are denoted in uppercase and observations in lowercase; vectors are represented with lowercase bold and matrices with uppercase bold.

is continuous and distributed with constant variance. In addition the LRM may also assume that the endogenous variable is normally distributed. However this assumption is not needed for estimating the model but only to obtain the exact distribution of the parameters in the model. In the case of large samples one may not need to assume normality in a LRM as inference on parameters is based on asymptotic theory (c.f Amemiya, 1985). These assumptions may be inappropriate if the endogenous variable is discrete (binary or categorical)—or continuous but non-normal.[11] GLMs overcome these limitations. They extend classic linear regression to a family of models with non-normal endogenous variables. In what follows, random variables are denoted in uppercase and observations in lowercase; vectors are represented with lowercase bold and matrices with uppercase bold.

Consider a sample of ![]() observations of a scalar dependent variable (

observations of a scalar dependent variable (![]() ) and a set of K exogenous variables (

) and a set of K exogenous variables (![]() ). This data is specified as

). This data is specified as ![]() , where

, where ![]() is a

is a ![]() column vector. Each observation

column vector. Each observation ![]() is assumed to be a realization of a random variable

is assumed to be a realization of a random variable ![]() independently distributed with mean

independently distributed with mean ![]() . The classic regression model with additive errors for the

. The classic regression model with additive errors for the ![]() observation can be written as

observation can be written as

|

|

(10.1) |

where ![]() denotes the conditional expectation[12] of the random variable

denotes the conditional expectation[12] of the random variable ![]() given

given ![]() , and

, and ![]() is a disturbance or random error. From equation (10.1) we see that the dependent variable is decomposed into two components: a systematic or deterministic component given the exogenous variables and an error component. The deterministic component is the conditional expectation

is a disturbance or random error. From equation (10.1) we see that the dependent variable is decomposed into two components: a systematic or deterministic component given the exogenous variables and an error component. The deterministic component is the conditional expectation ![]() , while the error component, attributed to random variation, is

, while the error component, attributed to random variation, is ![]() .

.

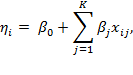

Equation (10.1) is a general representation of regression analysis. It attempts to explain the variation in the dependent variable through the conditional expectation without imposing any functional form on it. If we specify a linear functional form of the conditional expectation ![]() we obtain the classic linear regression model. Then, the systematic part of the model may be written

we obtain the classic linear regression model. Then, the systematic part of the model may be written

|

|

(10.2) |

where ![]() is the value of the

is the value of the ![]() exogenous variable for observation

exogenous variable for observation ![]() . To show the relation between a linear regression model and a generalized linear model it will become convenient to denote the right-hand side of equation (10.1) by

. To show the relation between a linear regression model and a generalized linear model it will become convenient to denote the right-hand side of equation (10.1) by ![]() , referred to as the predictor in the generalized linear model. Thus we can write

, referred to as the predictor in the generalized linear model. Thus we can write

|

|

(10.3) |

and the systematic part can be expressed as

|

|

(10.4) |

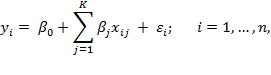

Equations (10.1) to(10.4) lead to the familiar linear regression model:

|

|

(10.5) |

where ![]() ,

, ![]() ,…,

,…, ![]() are parameters whose values are unknown and need to be estimated from the data.[13] Note that in the linear regression model of equation (10.6), the conditional expectation is equal to the linear predictor:

are parameters whose values are unknown and need to be estimated from the data.[13] Note that in the linear regression model of equation (10.6), the conditional expectation is equal to the linear predictor:

|

|

(10.6) |

The LRM additionally assumes that the errors ![]() are independent, with zero mean, constant variance

are independent, with zero mean, constant variance ![]() and follow a Gaussian or normal distribution.[14] Often the assumptions on

and follow a Gaussian or normal distribution.[14] Often the assumptions on ![]() are conditional on the exogenous variables, as these are possibly stochastic or random. Then, the errors have zero mean and homoscedastic or identical variance conditional on the exogenous variables, that is,

are conditional on the exogenous variables, as these are possibly stochastic or random. Then, the errors have zero mean and homoscedastic or identical variance conditional on the exogenous variables, that is, ![]() . Due to the relationship between

. Due to the relationship between ![]() and

and ![]() , the dependent variable is also normally distributed with constant variance. In other words, in a LRM, the distribution of the dependent variable is derived from the distribution of the disturbance. As explained in section 10.2.2, in a GLM the distribution of the dependent variable is specified directly.

, the dependent variable is also normally distributed with constant variance. In other words, in a LRM, the distribution of the dependent variable is derived from the distribution of the disturbance. As explained in section 10.2.2, in a GLM the distribution of the dependent variable is specified directly.

10.2.2 The Generalization

The GLM family of models involves predicting a function of the conditional mean of a dependent variable as a linear combination of a set of explanatory variables. Classic linear regression is a specific case of a GLM in which the conditional expectation of the dependent variable is modelled by the identity function. GLMs extend the domain of applicability of classic linear regression to contexts where the dependent variable is not continuous or normally distributed. GLMs also permit us to model continuous dependent variables that have positively skewed distributions.

Generalized linear models relax the assumption of additive error in equation (10.1). The random component is now attributed to the dependent variable itself. Thus, for GLMs we need to specify the conditional distribution of the dependent variable given the values of the explanatory variables, denoted as ![]() . These distributions often belong to the linear exponential family, such as the Gaussian, binomial, poisson, and gamma, among others—although recently have been extended to non-exponential families (McCullagh and Nelder 1989).

. These distributions often belong to the linear exponential family, such as the Gaussian, binomial, poisson, and gamma, among others—although recently have been extended to non-exponential families (McCullagh and Nelder 1989).

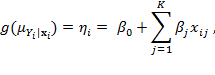

A generalized linear model is one that takes the form:

|

|

(10.7) |

where the systematic part or linear predictor (![]() ) is now a function (

) is now a function (![]() ) of the conditional expectation of the dependent variable

) of the conditional expectation of the dependent variable ![]() ;

; ![]() is a one-to-one differentiable function referred to as the link function, and

is a one-to-one differentiable function referred to as the link function, and ![]() is referred to as the linear predictor. The link function transforms the conditional expectation of the dependent variable to the linear predictor, which is a linear function of the explanatory variables that could be of any nature. This allows the linear predictor to include continuous or categorical variables, a combination of both, or interactions—as well as transformations of continuous variables. Note that when the link function

is referred to as the linear predictor. The link function transforms the conditional expectation of the dependent variable to the linear predictor, which is a linear function of the explanatory variables that could be of any nature. This allows the linear predictor to include continuous or categorical variables, a combination of both, or interactions—as well as transformations of continuous variables. Note that when the link function ![]() is the identity function, we have an LRM.

is the identity function, we have an LRM.

In most applications, as in the regression analysis with AF measures, the primary interest is the conditional mean ![]() . This could be easily retrieved from equation (10.7) by inverting the link function; hence we can write

. This could be easily retrieved from equation (10.7) by inverting the link function; hence we can write

|

|

(10.8) |

where ![]() is the inverse link

is the inverse link ![]() also called the mean function. Equations (10.7) and (10.8) provide two alternative specifications for a GLM, either as a linear model for the transformed conditional expectation of the dependent variable—given by (10.7)—or as a non-linear model for the conditional mean—given by (10.8).

also called the mean function. Equations (10.7) and (10.8) provide two alternative specifications for a GLM, either as a linear model for the transformed conditional expectation of the dependent variable—given by (10.7)—or as a non-linear model for the conditional mean—given by (10.8).

A GLM is thus composed of three components: (i) a random component resulting from the specification of the conditional distribution of the dependent variable given the values of the explanatory variables (this is implicit and cannot be seen directly); (ii) a linear predictor ![]() , and iii) a link function

, and iii) a link function ![]() (cf. Fox 2008: ch.15).

(cf. Fox 2008: ch.15).

The distribution of the dependent variable ![]() and the choice of the link function are intimately related and depend on the type of variable under study. The form of a proper link function is determined to some extent[15] by the range of the dependent variable and consequently by the range of variation of its conditional mean.

and the choice of the link function are intimately related and depend on the type of variable under study. The form of a proper link function is determined to some extent[15] by the range of the dependent variable and consequently by the range of variation of its conditional mean.

In the case of AF poverty measures, we may consider two types of dependent variables with a different range of variation and distribution. The first type is a binary indicator identifying multidimensionally poor households. This variable takes the value of one if the household is identified as multidimensionally poor and zero otherwise. The Bernoulli distribution is suitable to describe this kind of variable. A typical model in this case is the probit or logit model. As we will see, in a GLM this is equivalent to choosing a logit link. The second type of dependent variable that we could study in the AF approach is a proportion. The Adjusted Headcount Ratio ![]() and the incidence

and the incidence ![]() are fractions or proportions that take values in the unit interval. The binomial distribution may be suitable as a model for these proportions.

are fractions or proportions that take values in the unit interval. The binomial distribution may be suitable as a model for these proportions.

In each of these cases, the link function should map the range of variation of the dependent variable—![]() for the binary indicator and

for the binary indicator and ![]() for the proportion—to the whole real line

for the proportion—to the whole real line ![]() . The scale is chosen in such a way that the fitted values respect the range of variation of the dependent variable. Columns one to five in Table 10.1 present the two types of dependent variables with AF measures that we study in this section, along with their range of variation, type of model, level of analysis, and random variation described by the conditional distribution. The link and mean functions are explained in the examples in sections 10.3 and 10.4. Before presenting the examples, we briefly explain the estimation and goodness of fit of GLMs.

. The scale is chosen in such a way that the fitted values respect the range of variation of the dependent variable. Columns one to five in Table 10.1 present the two types of dependent variables with AF measures that we study in this section, along with their range of variation, type of model, level of analysis, and random variation described by the conditional distribution. The link and mean functions are explained in the examples in sections 10.3 and 10.4. Before presenting the examples, we briefly explain the estimation and goodness of fit of GLMs.

Table 10.1 Generalized Linear Regression Models with AF Measures

|

Dependent variable AF measure: |

Range of |

Regression Model |

Level |

Conditional Distribution |

Link |

Mean function |

||

|

Binary |

0,1 |

Probability |

Micro |

Bernoulli |

Logit |

|

|

|

|

|

[0,1] |

Proportion |

Macro |

Binomial |

Probit |

|

|

|

|

Note:

|

||||||||

10.2.3 Estimation and Goodness of Fit

Once we have selected the particular models of our study, we need to estimate the parameters and measure their precision. For this purpose we maximize the likelihood or log likelihood[16] of the parameters of our data denoted by ![]() .[17] The likelihood function of a parameter is the probability distribution of the parameter given

.[17] The likelihood function of a parameter is the probability distribution of the parameter given ![]() .

.

To assess goodness of fit of the possible estimates we use the scaled deviance. This statistic is formed from the logarithm of a ratio of likelihoods and measures the discrepancy, or goodness of fit, between the observed data and the fitted values generated by the model. To assess the discrepancy we use as a baseline the full or ‘saturated’ model. Given ![]() observations, the full model has

observations, the full model has ![]() parameters, one per observation. This model fits the data perfectly but is uninformative because it simply reproduces the data without any parsimony. Nonetheless it is useful for assessing discrepancy vis-à-vis a more parsimonious model that uses K parameters. Hence in the saturated model the estimated conditional mean

parameters, one per observation. This model fits the data perfectly but is uninformative because it simply reproduces the data without any parsimony. Nonetheless it is useful for assessing discrepancy vis-à-vis a more parsimonious model that uses K parameters. Hence in the saturated model the estimated conditional mean ![]() =

= ![]() and the scaled deviance is zero. For intermediate models, say with K parameters, the scaled deviance is positive.

and the scaled deviance is zero. For intermediate models, say with K parameters, the scaled deviance is positive.

The scaled deviance statistic

|

|

(10.9) |

is twice the difference between ![]() which is the maximum log likelihood of a saturated model or exact fit, and

which is the maximum log likelihood of a saturated model or exact fit, and ![]() the log likelihood of the current or reduced model.

the log likelihood of the current or reduced model.

The goodness of fit is assessed by a significance test of the null hypothesis that the current model holds against the alternative given by the saturated or full model. Under the null hypothesis, ![]() is approximately distributed as a

is approximately distributed as a ![]() random variable where the number of degrees of freedom equals the difference in the number of regression parameters in the full and the reduced models. However, an appropriate assessment of the goodness of fit is based on the conditional distribution of

random variable where the number of degrees of freedom equals the difference in the number of regression parameters in the full and the reduced models. However, an appropriate assessment of the goodness of fit is based on the conditional distribution of ![]() given

given ![]() . If

. If ![]() is not significant, it suggests that the additional parameters in the full model are unnecessary and that a more parsimonious model with fewer parameters may be sufficient.

is not significant, it suggests that the additional parameters in the full model are unnecessary and that a more parsimonious model with fewer parameters may be sufficient.

The scaled deviance statistic is also useful for model selection. Due to its additive property, the discrepancy between nested sets of models can be compared if maximum likelihood estimates are used. Suppose we are interested in comparing two models, A and B, that represent two different choices of explanatory variables, ![]() and

and ![]() , that are nested. Intuitively this means that all explanatory variables included in model A are also present in model B, a more complex or less parsimonious model. The improvement in fit may be assessed by a significance test of the null hypothesis that model A holds against the alternative given by model B. If the value of the scaled deviance statistic is found to be significant, there is an improvement in the fit of model B vis-à-vis model A, although a general conclusion on model selection should also consider the added complexity of model B.

, that are nested. Intuitively this means that all explanatory variables included in model A are also present in model B, a more complex or less parsimonious model. The improvement in fit may be assessed by a significance test of the null hypothesis that model A holds against the alternative given by model B. If the value of the scaled deviance statistic is found to be significant, there is an improvement in the fit of model B vis-à-vis model A, although a general conclusion on model selection should also consider the added complexity of model B.

10.3 Micro Regression Models with AF Measures

In the case of micro regression analysis, the focal variable is the (household) censored deprivation score ![]() . This score reflects the joint deprivations characterizing a household identified as multidimensionally poor. From a policy perspective a natural question that arises consequently is how to understand the ‘causes’ that underlie the (multidimensional) poverty status of a household. The simplest model for this purpose is a probability model, which we illustrate in this section; although one could also consider modelling the

. This score reflects the joint deprivations characterizing a household identified as multidimensionally poor. From a policy perspective a natural question that arises consequently is how to understand the ‘causes’ that underlie the (multidimensional) poverty status of a household. The simplest model for this purpose is a probability model, which we illustrate in this section; although one could also consider modelling the ![]() vector directly. We are thus interested in assessing the probability of a household being multidimensionally poor. Within the AF framework this is equivalent to comparing the deprivation score of a household

vector directly. We are thus interested in assessing the probability of a household being multidimensionally poor. Within the AF framework this is equivalent to comparing the deprivation score of a household ![]() with the multidimensional poverty cutoff (

with the multidimensional poverty cutoff (![]() ). If

). If ![]() is above the multidimensional poverty cutoff (

is above the multidimensional poverty cutoff (![]() ), the household is identified as multidimensionally poor. This is represented by a binary random variable (

), the household is identified as multidimensionally poor. This is represented by a binary random variable (![]() ) that takes the value of one if the household is identified as multidimensionally poor and zero otherwise, as follows:

) that takes the value of one if the household is identified as multidimensionally poor and zero otherwise, as follows:

|

|

(10.10) |

The outcomes of this binary variable occur with probability ![]() which is a conditional probability on the explanatory variables. For a (sampled) household

which is a conditional probability on the explanatory variables. For a (sampled) household ![]() identified as multidimensionally poor this is represented as

identified as multidimensionally poor this is represented as

|

|

(10.11) |

and thus the conditional mean equals the probability as follows:

|

|

(10.12) |

For a binary model the conditional distribution of the dependent variable, or random component in a GLM, is given by a Bernoulli distribution (Table 10.1). Thus the probability function of ![]() is

is

|

|

(10.13) |

To ensure that the conditional mean given by the conditional probability stays between zero and one, a GLM commonly considers two alternative link functions (![]() ). These are given by the quantile functions of the standard normal distribution function

). These are given by the quantile functions of the standard normal distribution function ![]() and the logistic distribution function

and the logistic distribution function  . The former is referred to as the probit link function and the latter as the logit link function. The probit link function does not have a direct interpretation, while the logit is directly interpretable as we discuss below.[19]

. The former is referred to as the probit link function and the latter as the logit link function. The probit link function does not have a direct interpretation, while the logit is directly interpretable as we discuss below.[19]

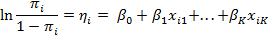

The logit of ![]() is the natural logarithm of the odds that the binary variable

is the natural logarithm of the odds that the binary variable ![]() takes a value of one rather than zero. In our context, this gives the relative chances of being multidimensionally poor. If the odds are ‘even’—that is, equal to one—the corresponding probability (

takes a value of one rather than zero. In our context, this gives the relative chances of being multidimensionally poor. If the odds are ‘even’—that is, equal to one—the corresponding probability (![]() of falling into either category, poor or non-poor, is 0.5, and the logit is zero. The logit model is a linear, additive model for the logarithm of odds as in equation (10.14), but it is also a multiplicative model for the odds as in equation (10.15):

of falling into either category, poor or non-poor, is 0.5, and the logit is zero. The logit model is a linear, additive model for the logarithm of odds as in equation (10.14), but it is also a multiplicative model for the odds as in equation (10.15):

|

|

(10.14) |

|

|

|

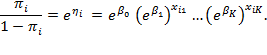

(10.15) |

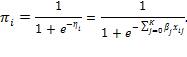

The conditional probability ![]() is then

is then

|

|

(10.16) |

The partial regression coefficients ![]() are interpreted as marginal changes of the logit, or as multiplicative effects on the odds. Thus, the coefficient

are interpreted as marginal changes of the logit, or as multiplicative effects on the odds. Thus, the coefficient ![]() indicates the change in the logit due to a one-unit increase in

indicates the change in the logit due to a one-unit increase in ![]() , and

, and ![]() is the multiplicative effect on the odds of increasing

is the multiplicative effect on the odds of increasing ![]() by one, while holding constant the other explanatory variables. For example, if the first explanatory variable increases by one unit, the odds ratio in equation (10.15) associated with this increase is

by one, while holding constant the other explanatory variables. For example, if the first explanatory variable increases by one unit, the odds ratio in equation (10.15) associated with this increase is ![]() , and

, and ![]() . For this reason,

. For this reason, ![]() is known as the odds ratio associated with a one-unit increase in

is known as the odds ratio associated with a one-unit increase in ![]() . To see the percentage change in the odds, we need to consider the sign of the estimated parameter. If

. To see the percentage change in the odds, we need to consider the sign of the estimated parameter. If ![]() is negative, the change in

is negative, the change in ![]() denotes a decrease in the odds; this decrease is obtained as

denotes a decrease in the odds; this decrease is obtained as ![]() . Likewise if

. Likewise if ![]() is positive, the change in

is positive, the change in ![]() indicates an increase in the odds. In this case, the increase is obtained as

indicates an increase in the odds. In this case, the increase is obtained as ![]()

10.3.1 A Micro-Regression Example

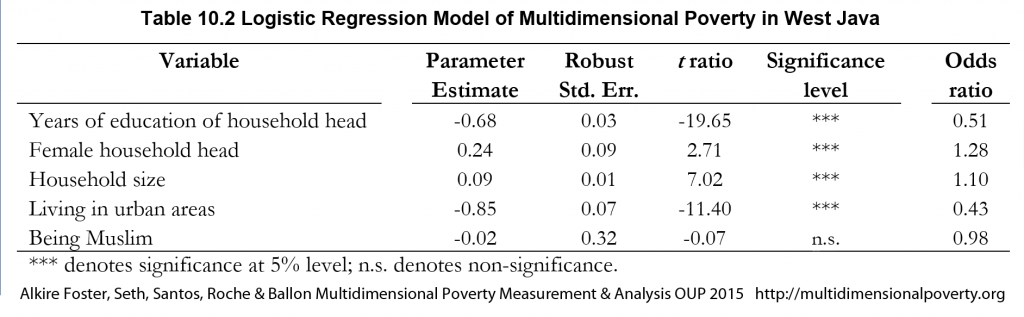

To illustrate the type of micro regression models that have been discussed, we use a subsample of the Indonesian Family Life Survey (IFLS) dataset. This is a dataset analysed by Ballon and Apablaza (2012) to assess multidimensional poverty in Indonesia during the period 1993–2007. The IFLS is a large-scale longitudinal survey of the socioeconomic, demographic, and health conditions of individuals, households, families, and communities in Indonesia. The sample is representative of about 83% of the population and contains over 30,000 individuals living in thirteen of the twenty-seven provinces in the country. Ballon and Apablaza (2012) measure multidimensional poverty at the household level in five equally weighted dimensions: education, housing, basic services, health issues, and material resources. For this illustration we retain a poverty cutoff of 33%. Thus a household is identified as multidimensionally poor if the sum of the weighted deprivations is greater than 33%. That is, ![]() takes the value of one if

takes the value of one if ![]() 33% and zero otherwise. Within the GLM framework this binary dependent variable is estimated by specifying a Bernoulli distribution and a logit link function. This is equivalent to a logit regression.

33% and zero otherwise. Within the GLM framework this binary dependent variable is estimated by specifying a Bernoulli distribution and a logit link function. This is equivalent to a logit regression.

The household poverty profile that we specify regresses the log of the odds of being multidimensionally poor (using ![]() on the demographic and socioeconomic characteristics of the household head. For this illustration we use data for West Java in 2007. West Java is a province of Indonesia located in the western part of the island of Java. It is the most populous and most densely populated of Indonesia’s provinces, which is why we selected it. The explanatory variables included in this illustration are non-indicator measurement variables and comprise:

on the demographic and socioeconomic characteristics of the household head. For this illustration we use data for West Java in 2007. West Java is a province of Indonesia located in the western part of the island of Java. It is the most populous and most densely populated of Indonesia’s provinces, which is why we selected it. The explanatory variables included in this illustration are non-indicator measurement variables and comprise:

· Education of the household head, defined as the number of years of education (not necessarily completed);

· The presence of a female household head, represented by a dummy variable taking a value of one if the household head is a female and zero if male;

· Household size, defined by the number of household members;

· The area in which the household resides, represented by a dummy variable taking a value of one if the household resides in the urban areas of West Java and zero otherwise;

· Muslim religion, represented by a dummy variable taking a value of one if the household’s main religion is Muslim and zero if not.

Table 10.2 Logistic Regression Model of Multidimensional Poverty in West Java

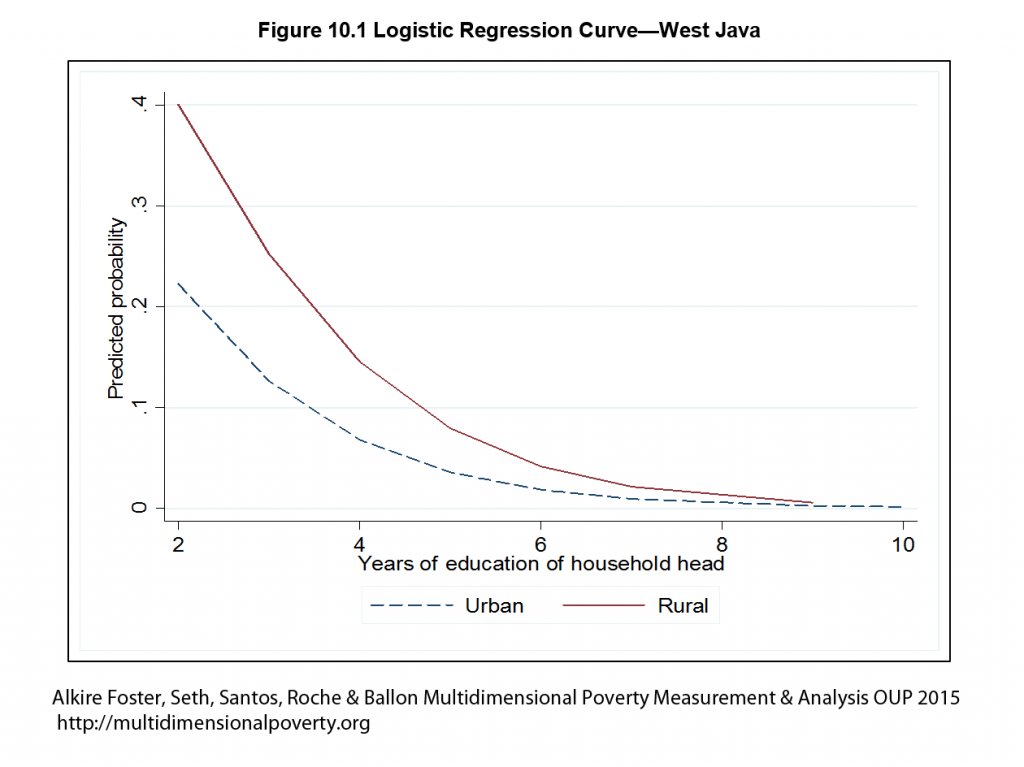

Table 10.2 reports the logistic regression results of this poverty profile for West Java in 2007. Columns two to five report the estimated regression parameters along with their standard errors, t ratios, and significance levels at 5%[20]. Apart from being Muslim, all other determinants are significant at the 5% level and show the expected signs. For a given household, the log of the odds of being multidimensionally poor decreases with the education of the household head and with an urban location and increases with the presence of a female household head and with household size. The odds ratio for years of education of the household head indicates that an increase of one year of education decreases the odds of being multidimensionally poor by 49%, ceteris paribus, whereas having a female household head increases the odds of being multidimensionally poor by 28%, ceteris paribus.[21] Similarly, the odds of a household of being multidimensionally poor decrease by 57% for households living in urban areas, ceteris paribus, and increase by 10% for each additional household member. Figure 10.1 shows the odds model for urban and rural areas as a function of the education of the household head, holding constant the gender status of the household head (female), assuming five household members (average), and being Muslim. The logistic curves show a decrease in the probability of a household being multidimensionally poor as the education of the household head improves. These probabilities are lower for households living in urban areas compared to rural ones.

Table 10.2 reports the logistic regression results of this poverty profile for West Java in 2007. Columns two to five report the estimated regression parameters along with their standard errors, t ratios, and significance levels at 5%[20]. Apart from being Muslim, all other determinants are significant at the 5% level and show the expected signs. For a given household, the log of the odds of being multidimensionally poor decreases with the education of the household head and with an urban location and increases with the presence of a female household head and with household size. The odds ratio for years of education of the household head indicates that an increase of one year of education decreases the odds of being multidimensionally poor by 49%, ceteris paribus, whereas having a female household head increases the odds of being multidimensionally poor by 28%, ceteris paribus.[21] Similarly, the odds of a household of being multidimensionally poor decrease by 57% for households living in urban areas, ceteris paribus, and increase by 10% for each additional household member. Figure 10.1 shows the odds model for urban and rural areas as a function of the education of the household head, holding constant the gender status of the household head (female), assuming five household members (average), and being Muslim. The logistic curves show a decrease in the probability of a household being multidimensionally poor as the education of the household head improves. These probabilities are lower for households living in urban areas compared to rural ones.

Figure 10.1 Logistic Regression Curve—West Java

As religion turns out to be statistically insignificant, we could consider an alternative poverty profile without religion as an explanatory variable (model B). To test whether this restrained model (without religion) is as good as the current model (model A), we compare the deviance statistics of both models.[22] Formally we test the following hypothesis:

![]()

![]() Model A is as good as model B

Model A is as good as model B

![]()

![]() Model A fits better than model B.

Model A fits better than model B.

To reject the null hypothesis we compare ![]() with the corresponding chi-square statistic

with the corresponding chi-square statistic ![]() with

with ![]() degrees of freedom. These degrees of freedom correspond to the difference in the number of parameters in model A and model B. A non-rejection of the null hypothesis indicates that both models are statistically equivalent and thus the most parsimonious model, which has the smaller number of explanatory variables, should be chosen—which is B in this context. A rejection of the null indicates a statistical justification for model A. In our case the comparison of the two nested models, A and B, gives a scaled deviance statistic

degrees of freedom. These degrees of freedom correspond to the difference in the number of parameters in model A and model B. A non-rejection of the null hypothesis indicates that both models are statistically equivalent and thus the most parsimonious model, which has the smaller number of explanatory variables, should be chosen—which is B in this context. A rejection of the null indicates a statistical justification for model A. In our case the comparison of the two nested models, A and B, gives a scaled deviance statistic ![]() of 0.05. We compare this value with the corresponding chi-square statistic of one degree of freedom and a 5% type I error rate; this gives a value of 3.84. As

of 0.05. We compare this value with the corresponding chi-square statistic of one degree of freedom and a 5% type I error rate; this gives a value of 3.84. As ![]() is smaller than 3.84, we cannot reject the null hypothesis; so we choose the more parsimonious model B and drop religion as an explanatory variable.

is smaller than 3.84, we cannot reject the null hypothesis; so we choose the more parsimonious model B and drop religion as an explanatory variable.

10.4 Macro Regression Modelsfor M0 and H

We now turn to the econometric modelling for the Adjusted Headcount Ratio![]() and the incidence of multidimensional poverty

and the incidence of multidimensional poverty ![]() as endogenous or dependent variables. As

as endogenous or dependent variables. As ![]() and

and ![]() are bounded between zero and one, an econometric model for these endogenous variables must account for the shape of their distribution.

are bounded between zero and one, an econometric model for these endogenous variables must account for the shape of their distribution. ![]() and

and ![]() are fractional (proportional) variables bounded between zero and one with the possibility of observing values at the boundaries. This restricted range of variation also applies for the conditional mean, which is the focus of our analysis. Thus specifying a linear model, which assumes that the endogenous variable and its mean take any value in the real line, and estimating it by ordinary least squares is not the right strategy, as this ignores the shape of the distribution of these dependent variables. Clearly if the interest of the research question is not in modelling the conditional mean of the proportion but rather in modelling the absolute change (between two time periods) of

are fractional (proportional) variables bounded between zero and one with the possibility of observing values at the boundaries. This restricted range of variation also applies for the conditional mean, which is the focus of our analysis. Thus specifying a linear model, which assumes that the endogenous variable and its mean take any value in the real line, and estimating it by ordinary least squares is not the right strategy, as this ignores the shape of the distribution of these dependent variables. Clearly if the interest of the research question is not in modelling the conditional mean of the proportion but rather in modelling the absolute change (between two time periods) of ![]() or

or ![]() , which can take any value, standard linear regression models may apply. In what follows we describe the statistical strategy for modelling the conditional mean of

, which can take any value, standard linear regression models may apply. In what follows we describe the statistical strategy for modelling the conditional mean of ![]() or

or ![]() as a function of a set of explanatory variables.

as a function of a set of explanatory variables.

Various approaches have been used in the literature to model a fraction or proportion. We can differentiate between two types of approaches—often referred to as one-step or two-step approaches. These differ in the treatment of the boundary values of the fractional dependent variable. In a one-step approach, one considers a single model for the entire distribution of the values of the proportion, where both the limiting observations and those falling inside the unit interval are modelled together. In a two-step approach, the observations at the boundaries are modelled separately from those falling inside the unit interval. In other words, in a two-step approach one considers a two-part model where the boundary observations are modelled as a multinomial model and remaining observations as a fractional one-step regression model (Wagner 2001; Ramalho, Ramalho and Murteira 2011). The decision whether a one- or a two-part model is appropriate is often based on theoretical economic arguments. Wagner (2001) illustrates this point. He models the export/sales ratio of a firm and argues that firms choose the profit-maximizing volume of exports, which can be zero, positive, or one. Thus the boundary values of zero or one may be interpreted as the result of a utility-maximizing mechanism. Following this theoretical economic argument he specifies a one-step fractional model for the exports/sales ratio. In the absence of an a priori criteria for the selection of either a one- or two-part model, Ramalho et al. (2011) propose a testing methodology that can be used for choosing between one-part and two-part models. In the case of ![]() or

or ![]() we consider that non-poverty and full poverty, the boundary values, as well as the positive values, are characterized by the same theoretical mechanism. This is thus represented by a one-part model. For further references on alternative estimation approaches for one-part models, see Wagner (2001) and Ramalho et al. (2011).

we consider that non-poverty and full poverty, the boundary values, as well as the positive values, are characterized by the same theoretical mechanism. This is thus represented by a one-part model. For further references on alternative estimation approaches for one-part models, see Wagner (2001) and Ramalho et al. (2011).

10.4.1 Modelling M0 or H

To model ![]() or

or ![]() we follow the modelling approach proposed by Papke and Wooldridge (1996). For this purpose we denote the Adjusted Headcount Ratio or the incidence by

we follow the modelling approach proposed by Papke and Wooldridge (1996). For this purpose we denote the Adjusted Headcount Ratio or the incidence by ![]() . For a given spatial aggregate, say a country, the Adjusted Headcount Ratio or the incidence is

. For a given spatial aggregate, say a country, the Adjusted Headcount Ratio or the incidence is ![]() . Papke and Wooldridge (PW hereafter) propose a particular quasi-likelihood method to estimate a proportion. The method follows Gourieroux, Monfort, and Trognon (1984) and McCullagh and Nelder (1989) and is based on the Bernoulli log-likelihood function which is given by

. Papke and Wooldridge (PW hereafter) propose a particular quasi-likelihood method to estimate a proportion. The method follows Gourieroux, Monfort, and Trognon (1984) and McCullagh and Nelder (1989) and is based on the Bernoulli log-likelihood function which is given by

where ![]() is a known nonlinear function satisfying

is a known nonlinear function satisfying ![]() . In the context of a GLM,

. In the context of a GLM, ![]() is the mean function

is the mean function ![]() defined in equation (10.8) as the inverse link function. PW suggest as possible specifications for

defined in equation (10.8) as the inverse link function. PW suggest as possible specifications for ![]() any cumulative distribution function, with the two most typical examples being the logistic function and the standard normal cumulative density function as described in Table 10.1.

any cumulative distribution function, with the two most typical examples being the logistic function and the standard normal cumulative density function as described in Table 10.1.

The quasi-maximum likelihood estimator (QML) obtained from equation (10.17) is consistent and asymptotically normal, provided that the conditional mean ![]() is correctly specified. This follows the QML theory where consistency and asymptotic normality characterize all QML estimators belonging to the linear exponential family of distributions, which is the case of the Bernoulli distribution of equation (10.17).

is correctly specified. This follows the QML theory where consistency and asymptotic normality characterize all QML estimators belonging to the linear exponential family of distributions, which is the case of the Bernoulli distribution of equation (10.17).

10.4.2 Econometric issues for an empirical model of M0 or H

We would like to conclude with a few recommendations for performing a macro regression with ![]() or

or ![]() as explained variables. First, we suggest testing for linearity before specifying a non-linear functional form. For this purpose one can apply the Ramsey RESET[23] test of functional misspecification. The test consists of evaluating the presence of nonlinear patterns in the residuals that could be explained by higher-order polynomials of the dependent variable. Second, we recommend testing for possible endogeneity using a two-stage or instrumental variable (IV) estimation. In regressions of the type of the macrodeterminants of

as explained variables. First, we suggest testing for linearity before specifying a non-linear functional form. For this purpose one can apply the Ramsey RESET[23] test of functional misspecification. The test consists of evaluating the presence of nonlinear patterns in the residuals that could be explained by higher-order polynomials of the dependent variable. Second, we recommend testing for possible endogeneity using a two-stage or instrumental variable (IV) estimation. In regressions of the type of the macrodeterminants of ![]() or

or ![]() it is very likely that there will be a correlation between one or more of the explanatory variables and the error term. Let us suppose we regress the Adjusted Headcount Ratio on the logarithm of the per capita gross national income in PPP of the same year for a group of countries. This is the GNI converted to international dollars using purchasing power parity rates. This gives a contemporaneous model for the semi-elasticity between growth and poverty. In this very simple model, it is highly likely that the GNI would be correlated with the disturbance of the equation, which consists of unobserved variables affecting the poverty rate. This violates a necessary condition for the consistency of standard linear estimators. To deal with endogeneity, often one replaces the endogenous explanatory variable with a proxy assumed to be correlated with the endogenous explanatory variable but uncorrelated with the error term.

it is very likely that there will be a correlation between one or more of the explanatory variables and the error term. Let us suppose we regress the Adjusted Headcount Ratio on the logarithm of the per capita gross national income in PPP of the same year for a group of countries. This is the GNI converted to international dollars using purchasing power parity rates. This gives a contemporaneous model for the semi-elasticity between growth and poverty. In this very simple model, it is highly likely that the GNI would be correlated with the disturbance of the equation, which consists of unobserved variables affecting the poverty rate. This violates a necessary condition for the consistency of standard linear estimators. To deal with endogeneity, often one replaces the endogenous explanatory variable with a proxy assumed to be correlated with the endogenous explanatory variable but uncorrelated with the error term.

Third, one is also very likely to find measurement errors among the explanatory variables in a model for ![]() or

or ![]() . This issue can also be treated with the IV method by replacing the measured-with-error variable with a proxy. To minimize the loss of efficiency that may result from an IV estimation, one can complement the estimation results using the Generalized Method of Moments. Lastly, we would like to point out that although this Chapter has focused on the modelling of levels of poverty (rates of poverty:

. This issue can also be treated with the IV method by replacing the measured-with-error variable with a proxy. To minimize the loss of efficiency that may result from an IV estimation, one can complement the estimation results using the Generalized Method of Moments. Lastly, we would like to point out that although this Chapter has focused on the modelling of levels of poverty (rates of poverty: ![]() ,

, ![]() ), it is at once straightforward and necessary to analyse changes in poverty. It suffices to estimate the model in levels and then compute the marginal effects of the expected poverty rate with respect to the explanatory variables included in the model.

), it is at once straightforward and necessary to analyse changes in poverty. It suffices to estimate the model in levels and then compute the marginal effects of the expected poverty rate with respect to the explanatory variables included in the model.

Bibliography

Amemiya, T. (1985). Advanced Econometrics. Harvard University Press.

Ballon, P. and Apablaza, M. (2012). ‘Multidimensional Poverty Dynamics in Indonesia’. Paper presented at the Research Workshop on Dynamic Comparison between Multidimensional Poverty and Monetary Poverty. OPHI, University of Oxford.

Barro, R. J. (2003). ‘Determinants of Economic Growth in a Panel of Countries’. Annals of Economics and Finance, 4(2): 231–274.

Bound, J., Jaeger, D. A., and Baker, R. M. (1995). ‘Problems with Instrumental Variables Estimation when the Correlation between the Instruments and the Endogenous Explanatory Variable Is Weak’. Journal of the American Statistical Association, 90(430): 443–450.

De Janvry, A. and Sadoulet, E. (2010). ‘Agricultural Growth and Poverty Reduction: Additional Evidence’. The World Bank Research Observer, 25(1): 1–20.

Dobson, A. J. (2001). An Introduction to Generalized Linear Models. CRC Press.

Dollar, D. and Kraay, A. (2004). ‘Trade, Growth, and Poverty’. The Economic Journal, 114(493): F22–F49.

Firth, D. (1991). ‘Generalized Linear Models’, in D. V. Hinkley, N. Reid, and E. J. Snell (eds.), Statistical Theory and Modeling’. Chapman and Hall.

Foster, J. and Székely, M. (2008). ‘Is Economic Growth Good for the Poor? Tracking Low Incomes Using General Means’. International Economic Review, 49(4): 1143–1172.

Gourieroux, C., Monfort, A., and Trognon, A. (1984). ‘Pseudo Maximum Likelihood Methods: Theory’. Econometrica, 52(3): 681–700.

Haughton, J. H. and Khandker, S. R. (2009). Handbook on Poverty and Inequality. World Bank.

McCullagh, P. and Nelder, J. A. (1989). Generalized Linear Models. (2nd ed.). Chapman & Hall/CRC.

Nelder, J. A. and Wedderburn. R. W. M. (1972). ‘Generalized Linear Models’. Journal of the Royal Statistical Society, Series A 135: 370–384.

Papke, L. E. and Wooldridge, J. M. (1996). ‘Econometric Methods for Fractional Response Variables with and Application to 401(k) Plan Participation Rates’. Journal of Applied Econometrics, 11(6): 619–632.

Rabe-Hesketh, S. and Skrondal, A. (2012). Multilevel and Longitudinal Modeling Using Stata. Volume I: Continuous Responses. (3rd ed.). Stata Press.

Ramalho, E. A., et al. (2011): Ramalho, E. A., Ramalho, J. J., and Murteira, J. M. (2011). ‘Alternative Estimating and Testing Empirical Strategies for Fractional Regression Models’. Journal of Economic Surveys, 25(1): 19–68.

Ravallion, M. (2001). ‘Growth, Inequality and Poverty: Looking beyond Averages’. World Development, 29(11): 1803–1815.

Roelen, K. and Notten, G. (2011). The Breadth of Child Poverty in Europe: An Investigation into Overlap and Accumulation of Deprivations. UNICEF Innocenti Research Centre.

Skrondal, A. and Rabe-Hesketh, S. (2004). Generalized Latent Variable Modeling: Multilevel, Longitudinal, and Structural Equation Models. CRC Press.

Stock, J. H., Wright, J. H., and Yogo, M. (2002). ‘A Survey of Weak Instruments and Weak Identification in Generalized Method of Moments’. Journal of Business & Economic Statistics, 20(4): 518–529.

Wagner, J. (2001). ‘A Note on the Firm Size–Export Relationship’. Small Business Economics, 17(4): 229–237.

[1] Cf. Nelder and Wedderburn (1972) and McCullagh and Nelder (1989).

[2] Also referred to as models for proportions.

[3] Skrondal and Rabe-Hesketh (2004), Rabe-Hesketh and Skrondal (2012) address this extension.

[4] The term determinants shall be understood in a ‘weak’ sense and refers to ‘proximate’ causes of poverty as defined in Haughton and Khandker (2009: 147).

[5] Also called independent, exogenous, or explanatory variables. We prefer the terms ‘exogenous’ or ‘explanatory’ to refer to the right-hand-side variables of a regression. In this section we use both terms interchangeably.

[6] See, for example, Bound, Jaeger, and Baker (1995) and Stock, Wright, and Yogo (2002).

[7] These are variables with explanatory power that were not used when constructing the poverty measure. These variables are expected to be uncorrelated with the error term of the model.

[8] Small-sample econometric and statistical techniques could be envisaged in the case of aggregates with very few categories.

[9] See, for example, De Janvry and Sadoulet (2010) and Roelenand Notten (2011).

[10] In the statistical literature ![]() is referred to as a regressor or covariate that is exogenous when the assumptions on the disturbance term are conditional on the covariates. In our exposition, all assumptions on the disturbance term or the dependent variable are conditional on the regressors so we use the term ‘exogenous’ instead of the generic term regressor. By ‘exogenous’ we mean non-stochastic or conditionally stochastic right-hand-side variables.

is referred to as a regressor or covariate that is exogenous when the assumptions on the disturbance term are conditional on the covariates. In our exposition, all assumptions on the disturbance term or the dependent variable are conditional on the regressors so we use the term ‘exogenous’ instead of the generic term regressor. By ‘exogenous’ we mean non-stochastic or conditionally stochastic right-hand-side variables.

[11] An example of a non-normal continuous variable is income (consumption expenditures). The distribution of income is skewed (to the right), takes on only positive values, and is often heteroscedastic.

[12] Or conditional mean. We use both terms interchangeably.

[13] An equivalent expression of the LRM is a matrix representation of the form

![]() , where

, where ![]() is an

is an ![]() vector of observations;

vector of observations; ![]() is an

is an ![]() vector of disturbances;

vector of disturbances; ![]() is a

is a ![]() matrix of explanatory variables, where each row refers to a different observation each column to a different explanatory variable; and

matrix of explanatory variables, where each row refers to a different observation each column to a different explanatory variable; and ![]() is a

is a ![]() vector of parameters. However for the expositional purposes of this Chapter we do not use the matrix representation but rather the one specified in equation (10.5).

vector of parameters. However for the expositional purposes of this Chapter we do not use the matrix representation but rather the one specified in equation (10.5).

[14] To denote a random variable as normally distributed we follow the statistical convention and denote it as ![]() .

.

[15] The range of variation of the dependent variable is a mild requirement for the choice of a proper link function. As noted by Firth (1991) this mild requirement is complemented by multiple criteria where the choice of a proper link function is made on the grounds of its fit to the data, the ease of interpretation of parameters in the linear predictor, and the existence of simple sufficient statistics.

[16] The parameters in a GLM are estimated by a numerical algorithm, namely, iterative weighted least squares (IWLS). For models with the links considered in this section, the IWLS algorithm is equivalent to the Newton–Raphson method and also coincides with Fisher scoring (McCullagh and Nelder 1989).

[17] Note we drop the subscript ![]() as the log likelihood depends on the full sample. For ease of exposition we also write

as the log likelihood depends on the full sample. For ease of exposition we also write ![]() as

as ![]() .

.

[18] Note ![]() and

and ![]() are the cumulative distribution functions of the standard-normal and logistic distributions, respectively.

are the cumulative distribution functions of the standard-normal and logistic distributions, respectively.

[19] Alternative link functions include the log-log and the complementary log-log links; however, these two are not symmetric around the median.

[20] Note we can also report marginal effects if the interest is to see the effect of an explanatory variable on the change of the probability.

[21] All estimated parameters exhibiting a negative sign denote a decrease in the odds; this is obtained as (1-odds ratio)×100. Likewise, estimated parameters with a positive sign denote an increase in the odds; this is obtained as (odds ratio-1)×100. For the effect of education we have (1-0.51)×100, and for the effect of gender we have (1.28-1)×100%.

[22] The deviance statistic: ![]() .

.

[23] RESET stands for Regression Equation Specification Error Test.